Sri Lanka is contending with a high risk of default on its local currency bonds as it seeks to reduce debt, key to winning financing from the International Monetary Fund to bring relief to the crisis-hit island.

Fitch Ratings’s ‘CCC’ rating on long-term local currency debt that was affirmed in May “reflects a high risk that local-currency debt will be included in debt restructuring,” Sagarika Chandra, Hong Kong-based associate director, wrote in a statement. Sri Lanka had $30 billion of foreign debt and $34 billion of domestic debt as of the end of April.

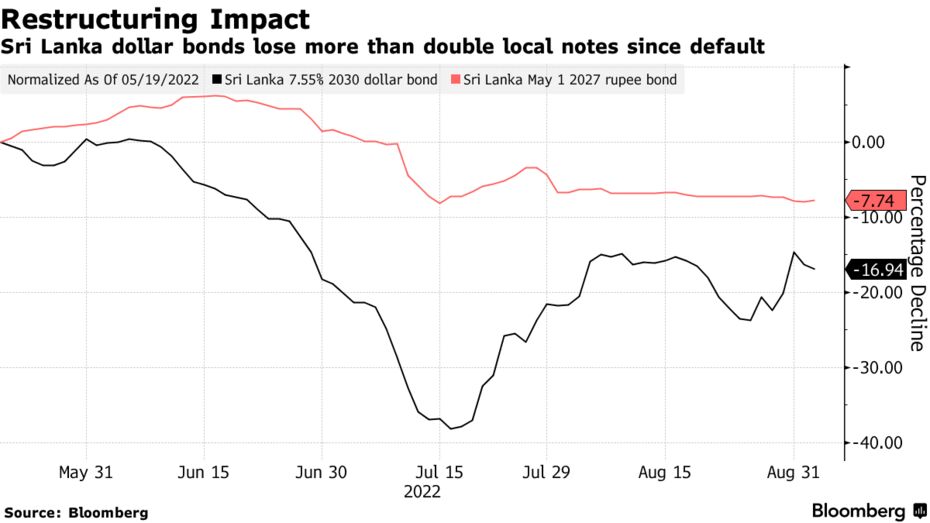

Sri Lanka defaulted on its dollar debt in May for the first time, and must clinch a restructuring deal with private bondholders and official creditors including China, Japan, and India to get the IMF board’s nod for a $2.9 billion loan. The nation faces a lawsuit in a US court over its proposed debt recast, with one of the bondholders, Hamilton Reserve Bank Ltd., accusing Sri Lanka of setting terms that favor domestic banks.

“There is a big question mark over whether sustainable levels of debt can be reached by just restructuring US dollar market and concessional debt,” said Kenneth Akintewe, head of Asian sovereign debt at abrdn in Singapore. “Arguably, local currency debt needs to be restructured too in order to reach what the IMF would see as sustainable levels.”

There are mixed signals from the government. President Ranil Wickremesinghe in August said the government was looking at including local bonds in the debt restructuring. Meanwhile, central Bank Governor Nandalal Weerasinghe has said he was confident the nation’s debt can be made sustainable without restructuring domestic debt.

Sri Lanka is walking a tightrope as it juggles the need to meet the IMF demands while ensuring the impact of the debt restructuring on the economy is manageable. Fitch warned that “a default on local-currency debt could have adverse effects on Sri Lanka’s banking sector that would erode the net benefits of such a restructuring.”

Officials are working with financial and legal advisers on a debt restructuring strategy and intend to make a presentation to the creditors in the next few weeks, the finance ministry said last week.

Imposing a debt restructuring on local currency debt could also prove challenging as the rating company views public support for the government as “weak,” and anticipates risks to reforms from political instability. An interim budget last week raised tax rates and included reforms to restore the nation’s fiscal health and meet IMF requirements.

“If there is a haircut on these bonds also, there will be a huge impact on the banking sector,” said Sanath Manatunge, chief executive officer at Commercial Bank of Ceylon PLC, adding that it would also make the restructured sovereign dollar bonds vulnerable.

Bloomberg.